Are you Plastic Tax Ready?

If you manufacture or import pre-filled or empty plastic packaging you could be affected by the Plastic Packaging Tax.

What is the Plastic Packaging Tax?

The Plastic Packaging Tax is being introduced by HMRC and will come into force from April 2022. All eligible businesses will be liable to pay £210.83 per tonne on plastic packaging placed on the UK market that has less than 30% recycled plastic content.

The new tax will be delivered separately to existing packaging waste regulations, and aims to help tackle plastic packaging waste, by providing a financial incentive to drive the development, design and use, of recycled content in packaging.

Who will be obligated for the Plastic Packaging Tax?

Companies that handle more than 10 tonnes of plastic packaging, including both packaging manufactured in the UK and imported pre-filled or empty plastic packaging, will be required to register with HMRC. The tax will be payable on all plastic packaging with less than 30% recycled content.

The tax does not apply to plastic packaging that has more than 30% recycled content, or packaging that is not predominately plastic by weight. There are a small number of other exemptions, but the tax is expected to have a significant impact on businesses across a vast variety of sectors.

What will the Plastic Tax cost?

The Government have set the tax at £210.83 per tonne of plastic packaging placed onto the UK market that cannot be verified as having a minimum of 30% recycled content. The rate will be subject to review to ensure effectiveness in increasing the use of recycled plastic.

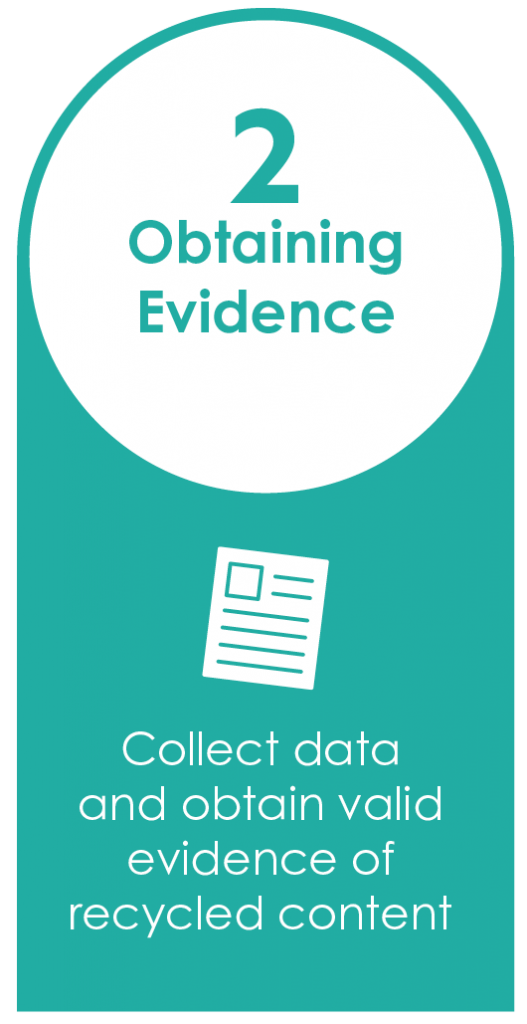

You will not pay the tax on any plastic packaging that has more than 30% recycled content, but you must be able to provide robust evidence to demonstrate this.

Providing a clear and auditable due diligence trail will be pivotal in satisfying HMRC that a number of thresholds tests have been met. If you are unable to demonstrate these requirements it will be assumed that your plastic packaging contains less than 30% recycled content and will be liable for the tax.

You must be able to prove:

- Whether you place more or less than 10 tonnes of plastic packaging on the market.

- The tonnage of plastic packaging manufactured in, or imported into, the UK.

- The recycled plastic used in your packaging conforms to BS and ISO standards.

- A mass balance exercise demonstrating the proportion of recycled plastic as a percentage of total plastic per weight.

- The date the packaging was manufactured or imported into free circulation and packaging exported either directly by yourselves or by your customers.

Our team is helping producers liable under the Plastic Packaging Tax, for more information and to understand exactly how we can help you...

Next Steps

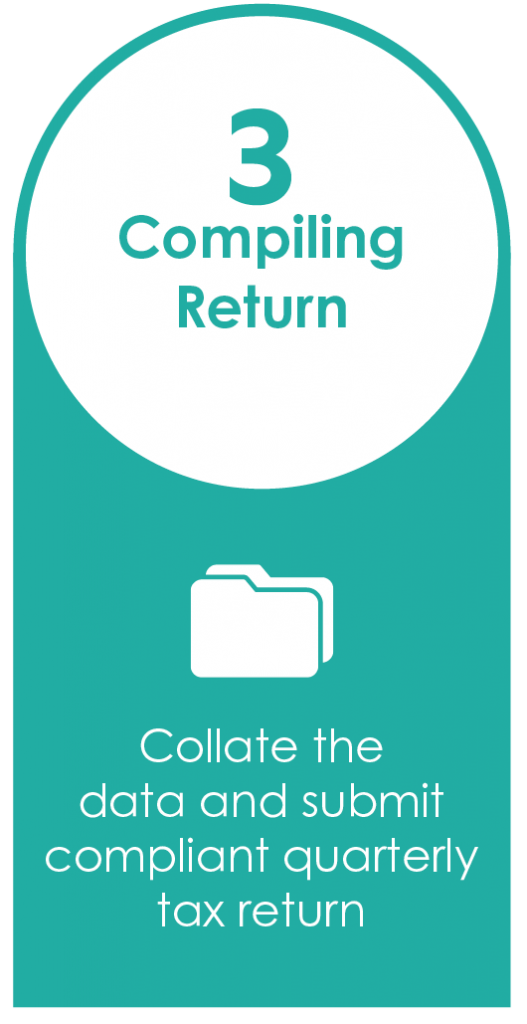

HMRC have produced draft legislation and have stated that the plastic tax will become law in April 2022. It is expected that liable businesses will be required to register with HMRC from January 2022 and submit quarterly tax returns and pay any tax due each from April 2022 onwards.

If you think you will be liable to pay the Plastic Packaging Tax it is vital that you review the plastic packaging used within your business and take steps to become plastic tax compliant.

We can help...

With over two decades experience in dealing with packaging data we can help you to identify packaging in scope of the tax, determine the recycle content, provide a robust auditable trail and calculate the amount of tax to be paid – contact our team today!

Our service includes guidance on...